2nd Quarter Estimated Taxes Due 2025 Due Date. This means taxpayers need to pay most of the tax they expect to owe during the year, as income is received. Estimated tax payments for the 2nd quarter of 2025 are also due june 17.

January 15, 2025 (for income earned between september 1 and december 31, 2025) For each partial or full month you don’t pay the tax in full, the penalty increases.

What Are The Quarterly Tax Dates For 2025 Moll Sydney, The due date for the second quarter’s taxes, covering the period of april 1 through may 31, 2025 is june 17, 2025. The due date for the second quarter's taxes, covering the period of april 1 through may 31, 2025 is june 17, 2025.

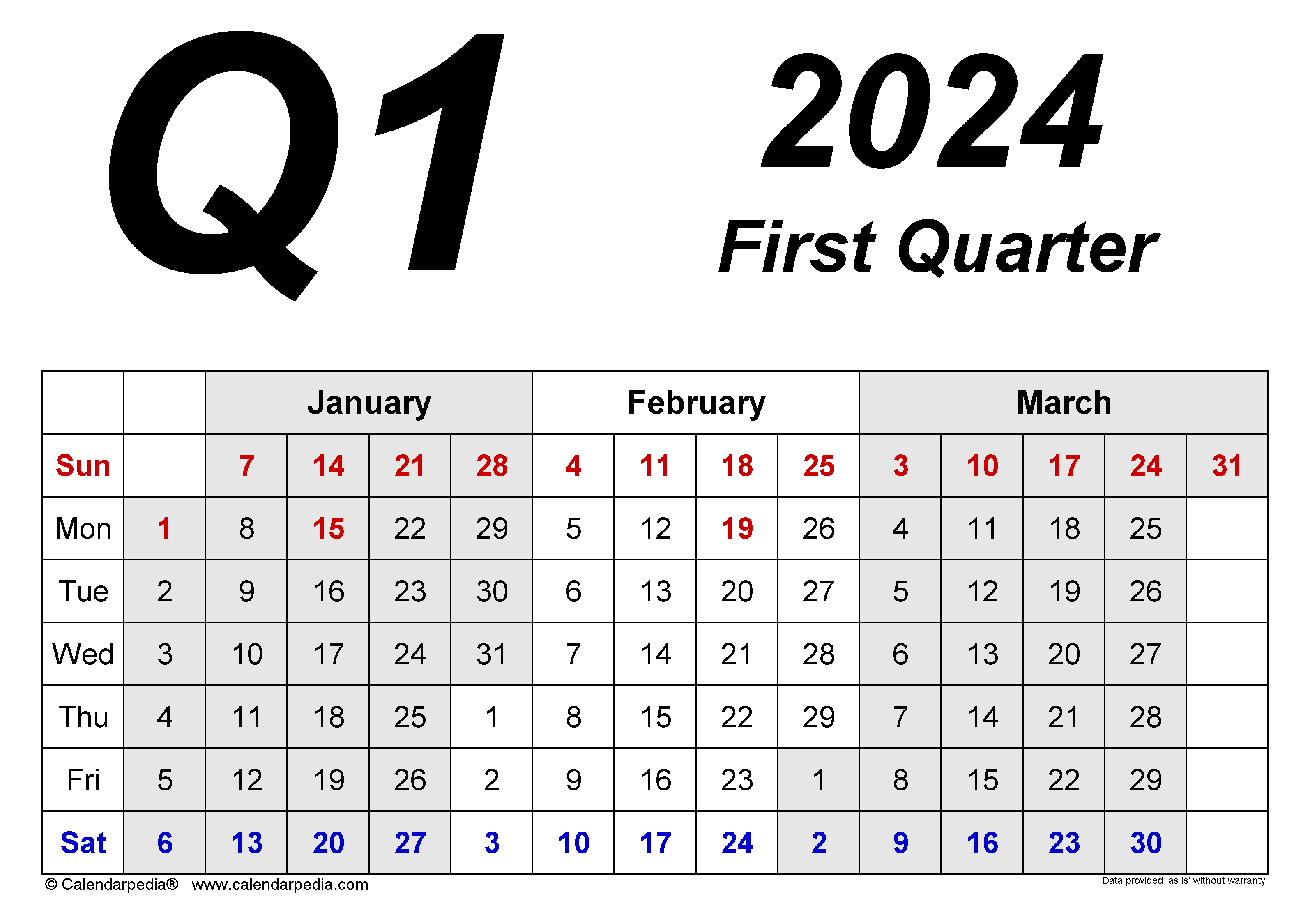

2025 Quarterly Estimated Tax Due Dates Irs Gisele Gabriela, 4q — january 15, 2025; July 7 also the due date for taxpayers permitted quarterly deposit of tds under sections 192, 194a, 194d, or 194h for the.

2025 Tax Cycle Dates Amanda Thomasine, The final quarterly payment is due january 2025. Estimated tax payments on income earned during the second quarter of the year (april 1, 2025, through may 31, 2025) are due today.

Reminder Second Quarter Estimated Taxes Due Alloy Silverstein, Estimated state taxes can be paid through most state. The estimated tax payment deadlines for individuals in 2025 are as follows:

2025 Irs Quarterly Tax Dates Bobbe Chloris, Choose the relevant assessment year and filing status (individual, huf, etc.). 2q — june 17, 2025;

Federal Quarterly Tax Payment Due Dates 2025 Election Elsa Nolana, Washington — the internal revenue service reminds taxpayers who pay estimated taxes that they have until june 15 to pay their estimated tax payment for the second quarter of tax year 2025 without penalty. Estimated tax is the method used to pay tax on income that isn't subject to withholding.

2025 Quarterly Estimated Tax Due Dates And Dates Rowe Shelby, Payments for estimated taxes are due on four different quarterly dates throughout the year. Based on preliminary and unaudited review, the company anticipates:

When Are Federal Taxes Due 2025 Date Diena Felicle, Individuals impacted by severe winter storms, flooding, landslides and mudslides in parts of the country may have automatic tax extensions that apply to estimated tax payments. Payments for estimated taxes are due on four different quarterly dates throughout the year.

Deadline For Estimated Tax Payments 2025 Melli Siouxie, There are two ways to do that: While specific dates could vary slightly from year to year, they will always fall in the middle of january, april, june, and september, typically on the 15th of the month.

2025 Corporate Estimated Tax Due Dates Kelli Annnora, The table below shows the payment deadlines for 2025. There are two ways to do that:

:max_bytes(150000):strip_icc()/balance-tax-return1-8b74d7fde2b44e5baa394d2ceda7d730.jpg)